In 1981, after nearly 100 years in business, IBM introduced the world to home computing through the launch of the IBM personal computer (PC). The relatively small machine offered home users the basics of personal computing, complete with two floppy disks, 16 kilobytes of memory (expandable to 256 kilobytes), an Intel processor chip, and a DOS operating system developed by a small, 36-person company called Microsoft.[ii] This invention would launch a technological revolution and would help grow the company to the giant it is today, with nearly 400,000 employees worldwide.

Twenty-four years later, in December 2004, IBM shocked the industry by selling its US $1.75 billion pivotal PC business to Lenovo, a company partially owned by the Chinese state. IBM employees, competitors and management pundits were stunned. How could a relatively unknown company, operating only in China, come to swallow the PC business of “Big Blue”?[iii] What did this mean for the PC industry?

Why would IBM want to exit the PC making business? In a word, margins. The PC industry is a low-margin, commodity-like industry. IBM realized it could increase its margins by selling the PC division and focusing on products with higher returns, such as servers and software, and technology services. Historically, IBM’s PC division made little profit and in some years, lost money. IBM felt the division was negatively affecting the company’s overall profitability. Over the next few years, IBM gradually sold its shares in Lenovo until its shares fell below the 5 per cent reporting requirement.

Lenovo, on the other hand, believed it knew the PC market well and was earning healthy returns in China. In an earlier attempt at an international venture, Lenovo failed to launch PCs in Spain, and thought the IBM purchase was an opportunity to introduce Lenovo to the world with the support of the trusted Big Blue brand. The deal instantly quadrupled Lenovo’s revenues, and gave Lenovo access to an invaluable pool of highly skilled IBM researchers, product designers, sales professionals and support personnel.

Can Chinese brands sell internationally?

Building an international brand requires years of development and investment, and an understanding of global customers in their unique markets.[iv] It takes time for a company to develop a reputation for quality and performance, and this is especially evident in technology industries. Some Asian companies, especially Korean (e.g., Samsung) and Japanese (e.g., Sony) ones, have built solid, thriving international brands. However, very few major brands have arisen from the emerging economic giants, China and India. When China and India liberalized their economies in the 1980s and 1990s, a widely shared fear in those countries was that foreign MNEs would enter local markets and destroy local, homegrown companies.[v] This did not happen. Instead, local companies have thrived and prospered, and have started acquiring the large MNEs that were originally thought to pose such a threat.

China’s large market base provides companies with an opportunity to grow and build cash flow and experience before venturing overseas.[vi] Increased foreign investments in local emerging markets have created a large base of prosperous citizens, with incomes to purchase both local and foreign products. This growing consumer mass has created a thriving base of small and medium sized businesses in emerging markets that are able to experiment, expand and build cash flow before venturing overseas.[vii]

The first Chinese companies to take advantage of freer markets and more prosperous consumers tended to compete on price, taking advantage of lower labour costs and offering competitive products that were mass produced at discounted prices. Instead of producing innovative, new products, Chinese companies mass-produced inexpensive knock-offs for sale internationally. While this situation still exists today, over time companies have realized that in order to continue to grow, they could no longer rely on organic growth opportunities, but rather would have to look outside their own borders for acquisition targets.[viii] The past few years have seen an increase in Chinese merger and acquisition activity. Recent prominent examples include Lenovo’s acquisition of IBM’s PC division and car manufacturer Geely’s acquisition of Volvo. While low-cost manufacturing continues to play a prominent role, it is no longer the driving force behind Chinese economic growth. China has become a technological innovator, with heavy investments in research and development. However, according to the consulting company McKinsey, how Chinese firms innovate is different from the approach adopted by MNEs in developed economy markets.[ix]

Gordon Orr and Erik Roth of McKinsey’s Shanghai office find that Chinese companies are weaker in three main areas:[x]

- They lack analytical tools for uncovering and understanding customer needs.

- Their corporate cultures are risk-averse.

- Corporate cultures tend to be authoritarian, with little of the internal collaboration that is necessary for the development of new ideas.

Chinese MNEs have attempted to remediate some of these problems, but often still lack a deep understanding of local foreign markets. However, Chinese companies excel at innovating through commercialization, which reflects a type of ‘trial and error’, and means they prefer to introduce products and see how these perform rather than doing extensive marketing research prior to market release.[xi] Traditionally, most of the innovations developed in China have tended to stay there, and the ‘trial and error’ approach is then an ‘analytically easy’ way to try to expand abroad. In general, the “market is so large that domestic companies have little incentive to adapt successful products for sale abroad”.[xii] As China continues to grow and develop, it is reasonable to expect that this situation will not continue, and we will see an increasing number of Chinese companies targeting global acquisitions.

Lenovo: The making of China’s first global brand

Liu Chuanzhi: Lenovo’s Steve Jobs

Lenovo’s founder, Liu Chuanzhi, is widely respected by Lenovo employees and Chinese citizens alike. Within Lenovo, he is referred to as “The Chairman”, and throughout China he is revered as a pioneer of China’s industrial and technological development.[xiii] Liu’s road to success was not an easy one. In 1968, Liu graduated from military college and was sent to work for the Chinese government as a researcher for the Ministry of Defence.[xiv] Unfortunately, his tenure as researcher did not last long, as he was sent to work on a state-owned farm to be “re-educated” during the Cultural Revolution of Chairman Mao Zedong of the Communist Party of China.[xv] The purpose of the Cultural Revolution was “to enforce socialism in the country by removing capitalist, traditional and cultural elements from Chinese society, and to impose Maoist orthodoxy within the Party”.[xvi]

Liu’s living conditions were dire, and he worried he would never be allowed to leave. He was fortunate that the Cultural Revolution ended two years later, and he was re-assigned to work at the Chinese Academy of Sciences in Beijing as a researcher. While he was lucky not to have been assigned to work in a factory, the job lacked fulfilment with no opportunities for movement or advancement.

With the death of Mao in the early 1980s, the new Chinese government began to introduce market reforms. The president of the Chinese Academy of Sciences was encouraged to visit the West and see if he could find ways to stimulate the economy. He chose to visit IBM, and brought back home his observations of how IBM commercialized its research and development initiatives. The Chinese government, intent on pushing forward reforms, invested RMB 200,000 (worth US $25,000 at the time) in seed funds for Liu’s new technology venture with ten other engineers. This venture was called “The Chinese Academy of Sciences Computer Technology Research Institute New Technology Development Co”[xvii] and was based out of an old guard shack in Beijing. Fortunately, the company changed its name to Legend (Lianxiang), but unfortunately, none of the founding engineers had any experience running a business.

One of the most important technologies developed by the founders was a chip card that enabled Chinese characters to be accessible on foreign-made computers.[xviii] Legend formed a partnership with a US PC company called AST, and Legend distributed the computers to market. In short order, Legend became so well known in China that Liu decided to produce a “Legendbranded PC” in 1990.[xix] Business took off.

In 1991, the Chinese government lowered import taxes on foreign goods. Suddenly, Legend’s virtual monopoly evaporated, and a flood of competitors entered the market. Legend was in a loss position for the first time.

“The most dangerous thing is to be successful”, said CFO Wong Wai Ming, “You then think every decision is the right one. That’s why you have to review what you do.”[xx] Liu realized he had to make changes quickly. He promoted a young, 29-year-old sales superstar named Yang Yuanqing to reorganize and invigorate the company. Yang decided that Legend’s next generation computer should have the fastest processor in the market, and in 1996 Legend was the first to introduce a Pentium-powered PC in China, at a lower price than that of competitive, slower PCs. Demand for the PCs exceeded expectations.

Legend made sure it was always one step ahead of the competition in China. When competitors introduced a comparable PC to the Pentium-powered Legend PC, Legend introduced an even faster one at a lower price. Legend strengthened its customer service and sales support, and became well known for its after sales service, which encouraged brand loyalty.[xxi] By 1997, Legend was the top-selling PC in China, a position it has never relinquished since.[xxii] But this wasn’t enough for Liu, and in 2005 after changing Legend’s name to Lenovo Group, Liu achieved his dream of running a global company. He acquired the PC business of giant multinational corporation IBM, in a deal that would stun IBM employees and competitors, and alarm the government of the United States of America.

The Asian tiger swallows a big blue giant

In 2004, IBM was the third largest PC vendor in the world, with a 5.2 per cent share of the market. Lenovo was the ninth largest, with 2 per cent of the market generated from sales in China (Figure 13.2).

Lenovo’s sales in 2004 were approximately US $3.8 billion, whereas IBM’s global PC sales were approximately US $10 billion.[xxiii] The acquisition deal, worth US $1.75 billion, involved US $800 million in cash, US $450 million in securities and US $500 million in debt assumption.[xxiv]

Lenovo agreed to manufacture the PCs and was allowed to use the IBM brand for five years, namely the well-known and trusted Think Product Group. The Think products include the ThinkCentre PC and ThinkPad for commercial clients, and the IdeaCentre PC and IdeaPad for retail clients. IBM agreed to provide consumer financing, marketing and warranty, maintenance and sales support. The new Lenovo would have 10,000 former IBM employees and 9,200 Lenovo employees, with global headquarters in New York. Offices in Raleigh, North Carolina and Beijing were maintained.

The market was sceptical about the prospect that Lenovo, a low-end manufacturer with no international presence or experience, could be successful in a global market. How could two drastically different companies, from distinctly diverse cultures, merge with any degree of success? Lenovo’s customers were predominantly Chinese consumers (over 50 per cent), and IBM’s customers were predominantly commercial entities (over 50 per cent). As Michael Dell, Chairman of Dell, stated, “We’re not a big fan of the idea of taking companies and smashing them together. When was the last time you saw a successful acquisition or merger in the computer industry?”[xxv]

Figure 13.2

The top 10 of the global PC market in 2004

Lenovo definitely had a difficult road to travel. The road was ultimately steep, bumpy and with a few detours.

Lenovo’s initial branding strategy: Preserve, educate, launch

Lenovo’s first priority post-acquisition was to ensure that it preserved existing IBM and Lenovo customer bases. By allowing Lenovo to use the IBM brand for five years, IBM also had a vested interest in Lenovo’s success. Not only did IBM own a significant number of shares in Lenovo, but there was an inherent risk in damage to IBM’s own brand if the venture was unsuccessful. Aiming to achieve stability in the first year after the acquisition, Lenovo retained all employees of IBM’s PC business despite their relatively high salary level compared to that prevailing at Lenovo. Lenovo’s initial surveys of 4,000 global IBM customers found that customers would continue to purchase Lenovo computers if three key factors were maintained: “quality, innovation and service and support”.[xxvi] Based on the research results, Lenovo’s branding strategy initially focused on a business as usual message, the “same people, same locations, same processes”.[xxvii] The IBM logo featured prominently in all advertisements and products. In this phase, Lenovo focused heavily on marketing to existing and potential large commercial clients and smaller business clients, given that this sector accounted for over 50 per cent of revenues.

In Lenovo’s second phase of its branding strategy, the Lenovo brand was cautiously introduced to the market as the manufacturer of the Think and Idea groups by removing the IBM logo and replacing it with Lenovo’s.[xxviii] Advertisements emphasized the “Think” and “Idea” brands, and removed references to IBM. The intent was to assure clients that this is the product that they had come to know and trust, and “by the way, Lenovo is the company making this product”.[xxix] Furthermore, the new company was restructured in order to reduce operational costs and improve Lenovo’s efficiency in the supply chain. Lenovo laid off 1,000 and 1,400 US-based employees in two consecutive years (2006 and 2007), and 750 positions were relocated to emerging countries such as Brazil, China and India.[xxx]

In the third phase of Lenovo’s post-acquisition process, the company focused on cultural integration. By forming an international leading team, offering global cross-training programmes and establishing a two-level research system that consists of central as well as business unit level research institutes, Lenovo enhanced the creation of competences and thus Lenovo’s long-term success. In addition, the third phase involved the launch of the Lenovo master brand, particularly in consumer emerging markets, such as India and Russia. Lenovo’s global tag line became, “Lenovo engineers exceptional PCs”.[xxxi] Lenovo wanted to highlight the importance innovation plays in the company, and believed using the word “engineer” would also appeal to its commercial client target market. The third branding phase involved an aggressive entry into the consumer segment in emerging markets. Lenovo believed it could leverage its successful Chinese strategy by adapting it to local emerging markets.

The first emerging market to be targeted was India. It was important for Lenovo to ensure its branding strategy did not emphasize low cost; otherwise, it risked losing the brand equity built with commercial clients. Lenovo understood that price is not the only driver for Indian customers; they are very brand-conscious. Lenovo’s brand strategy in India utilized Bollywood stars, positioning Lenovo as a cool, young, trendy brand, while making sure that the messaging was not inappropriate for its commercial client base.[xxxii] The strategy worked. Within 11 months, brand awareness soared from a nearly negligible base to approximately 70 per cent of consumers.[xxxiii]

Lenovo’s strategy execution was a bit bumpy at times. In 2008, after disappointing international sales, Lenovo sold its mobile handset division to its parent, Legend Holdings, for US $100 million. Lenovo’s CEO Bill Amelio was credited for successfully integrating Lenovo and IBM’s operational and supply chain activities. However, the organization was still operating as two separate entities in terms of overall strategy development and execution, research and development, and marketing.[xxxiv] Analysts claimed Lenovo had focused too heavily on the commercial market and was too slow introducing popular consumer products, such as the netbooks (an inexpensive, smaller version of a laptop). As a result, Lenovo was hit hard during the financial crisis in 2008. Orders from commercial clients declined significantly during this time period, and Lenovo lost money and market share in its developed economy markets.[xxxv]

In January 2009, Lenovo replaced CEO Bill Amelio and brought back its founding management team. The new team revisited its mobile strategy. PC competitors were beginning to offer mobile smart phones, and the industry expected demand for mobile computing devices to increase. Consequently, Lenovo bought back its handset unit from parent Legend Holdings for US $200 million, double the selling price from eighteen months earlier. Charles Guo from JP Morgan observed: “It makes you feel they are always a bit late. Also, the price tag is a bit high.”[xxxvi] With the founding management team back in place, Lenovo’s global strategy underwent an aggressive transformation. In 2009, Lenovo launched a global line of Idea PC’s targeting the consumer market. Lenovo calls this new strategy, ‘Protect and Attack’ and its new tag line is

“Lenovo, for those who doTM”.[xxxvii]

Lenovo’s current strategy: Protect and attack

Protect the base

In Lenovo’s developed economy markets, its strategy includes direct sales to commercial clients and global advertising in the consumer segment (e.g., sponsoring high-profile international sporting events). Lenovo also utilizes the Internet for advertising, since a majority of businesses and consumers are online. Developed economy markets represent 35.7 per cent of Lenovo’s overall sales, over half of which are sales to commercial clients.

In China, which in 2012 accounted for approximately 46.4 per cent of Lenovo’s overall revenues, Lenovo is focused on growing its share of the PC market, particularly in smaller cities and rural areas, and continuing to introduce new products, including mobile smart phones and tablets.[xxxviii] Lenovo is the number one selling smart phone in China, though it is largely unknown in developed economy markets. Lenovo’s Chinese market base is critical, both for the country’s contribution to Lenovo’s revenues and as a test market for new products and services. Apple is Lenovo’s most aggressive competitor in the mobile smart phone and tablet space in China.

Attack new markets

The ‘Attack’ component of Lenovo’s strategy focuses on gaining market share in emerging markets, including Russia, Ukraine, India, ASEAN countries (Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Laos, Cambodia, Brunei, Myanmar) and Latin America. Lenovo’s sales have really taken off, with unit shipments increasing by at least 40 per cent in all markets, particularly in Russia and Ukraine (+141 per cent) and India (+64.9 per cent).[xxxix] The emerging markets segment accounted for 17.9 per cent of Lenovo’s overall revenues.[xl] Local offices run marketing, sales and support initiatives, and though Lenovo has a common look and feel to its brand, country-specific advertising campaigns are strongly geared to local markets’ preferences.

Acquisitions have played an important role in Lenovo’s attack on the PC business in developed economy markets. Lenovo hopes it can make inroads into mobile computing with its ThinkPad and Idea tablets for commercial and consumer segments in developed economy markets. In 2012, it planned to release a new tablet that runs Windows 8 software.

Industry consolidation

Given the highly competitive nature of the PC industry and corresponding thin margins, industry consolidation is inevitable. In 2007, Acer acquired Gateway for US $710 million. In January 2011, Lenovo announced a joint venture with Japanese PC manufacturer NEC, whereby Lenovo would purchase 51 per cent of NEC for US $175 million.[xli] The joint venture increased Lenovo’s share of the Japanese market from 5 per cent to 25 per cent.[xlii] Lenovo also purchased Medion in Germany in 2011 for US $906 million.[xliii] Medion is a well-established consumer PC brand in Germany, and was a natural fit for Lenovo whose European customer base is primarily commercial. Lenovo’s last two acquisitions reflect its desire to expand beyond commercial business and towards an increased consumer presence in developed economy markets.

Competitive landscape

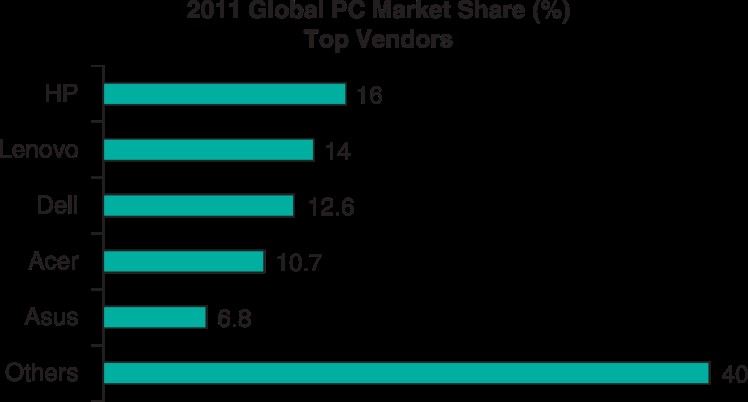

Lenovo’s ‘Protect and Attack’ global strategy appears to be paying off. In the fourth quarter of 2011, after years trailing in third or fourth place for total global PC market share, Lenovo overtook rival Dell for second place. The Top 5 PC manufacturers are displayed in Figure 13.3.

The market share graph presents an interesting illustration of the global PC market’s top competitors. HP leads the pack with 16 per cent share. HP is a leading hardware (printers, PCs, servers, tablets, etc.) manufacturer, software developer and technology services consultant to both consumer and business clients. HP is the dominant player in developed economy markets such as the United States. Despite its market share dominance, HP has struggled to define its strategy in recent years, partially due to industry woes suffered during the financial crisis that began in 2008. In mid-2011, HP announced plans to spin off its PC business from the rest of the corporation, reminiscent of IBM’s sale to Lenovo. No plans were announced for a sale, however, and the company stated that the split would allow focusing on “products that drive higher value solutions to enterprise, small and midsize business and public sector customers” while allowing the PC division to become more entrepreneurial and nimble.[xliv] The market reacted negatively to the news, and HP’s stock lost more than 43 per cent of its value in less than a year.[xlv] HP subsequently dismissed its CEO, and new CEO Meg Whitman has reversed the spinoff decision, stating that it would be very difficult for a new PC company to develop such a strong brand, and recognizing the PC division’s critical contribution to the corporation’s overall technology strategy.[xlvi]

Figure 13.3

Top vendors in the global PC market in 2011

Dell, Inc. is a large multinational computer technology company, with over 100,000 employees worldwide. The company, based in Texas, pioneered advancements in supply chain management and e-commerce PC sales. Consumers have since developed a keener interest in purchasing directly through retail outlets, which is hurting Dell’s business model. Dell is one of the top three server manufacturers after IBM and HP, and has been investing in its data storage and technology services business. Dell has been criticized for relying too heavily on its low-margin PC business and being too slow to market with mobile computing devices such as its Streak tablet, which has not sold well.[xlvii] Acer is a large, multinational enterprise from Taiwan with over 8,000 employees, selling notebook and desktop PCs, servers, tablets, smart phones, LCD monitors and projectors.[xlviii] While Lenovo has been focusing on business clients in developed economy markets, Acer’s strategy is to target price-conscious PC consumers. Acer has done well with its netbook sales. A netbook is an inexpensive version of a laptop, and its initial popularity helped propel the company to many years of growth. However, Acer has struggled in the last year due to the financial crisis and consumer preference for tablets over netbooks, as well as inventory management issues. Acer has quickly moved to introduce ultra-thin notebooks and tablets to attempt to re-gain some of the business it has lost.[xlix]

Asus is a multinational computer company launched by four former employees from Acer, with a global workforce of 10,000 employees.[l] Asus sells PCs, servers, smart phones, tablets, and also specializes in manufacturing motherboards for its own computers and also for some of the firm’s competitors. Asus has been praised for moving its innovations quickly to market, first with the Netbook, and then with tablets and ultra-thin notebooks.[li]

Apple Inc. is a multinational corporation with over 60,000 employees worldwide based in California that sells consumer electronics, computers and software. Apple is recognized as a leader in the mobile computing industry, and the iPad 2 has a commanding 55 per cent share of the tablet market.[lii] Rivals running Google’s Android mobile operating system and the upcoming Windows 8 touch screen software are expected to challenge Apple’s higher-priced mobile phones and tablets in the future. As Lenovo’s CEO Yang Yuanquing, stated, “Apple is very strong, but when IBM created the PC market there was just IBM, if you look at the PC industry now it is very diversified. I believe that will happen in tablets as well.”[liii]

What is the future for China’s most successful international brand?

The IBM-Lenovo PC deal is one of China’s most visible and successful forays into international brand extension. By all accounts, the acquisition was a success. Lenovo is the second largest PC vendor in the world, and is closing in on HP. Lenovo’s return to its emerging markets roots has played a big role in Lenovo’s current success, as do strategic acquisitions in Japan and Europe. Lenovo is well known for quality and customer service/support.

Lenovo’s biggest test will be to determine whether it is able to penetrate the consumer base in developed economy markets such as North America and Europe. Competitors in developed economy markets have developed strong consumer brands, including HP, Dell, Apple, Acer, Asus and Toshiba. Can Lenovo build brand awareness and loyalty in these markets organically, or should it pursue acquisition targets?

Experts argue that PCs will continue to be the preferred product for meeting commercial and consumer computing needs for some time to come. Tablets and mobile smart phones are currently ancillary devices to a laptop or PC, but as Lenovo and competitors begin to develop fully functional, powerful hybrids that combine the functionality of both PCs and tablets, will these devices replace PCs?

QUESTIONS

- What are Lenovo’s FSAs? How have these evolved over time?

- Was IBM’s decision to sell its global PC business to Lenovo a good one?

- Should Lenovo have focused on the commercial business in developed economy markets, or should it have targeted both commercial and consumer customers? Will it be able to gain lost ground organically in developed economy markets, or will it need to target another acquisition?

- As Lenovo continues to build its global brand, what potential consumer perception barriers may Lenovo encounter as a brand from China?

- What did Lenovo do well in terms of its global branding strategy? What could Lenovo have done better?

- Is Lenovo’s ‘Protect and Attack’ strategy positioning the firm properly for the future of the PC and mobile computing industry? What will this future look like, and what should Lenovo be doing now to prepare?

Notes

[i] This case was co-authored by Ms Denise Larsen and Professor Alain Verbeke.

[ii] www-03.ibm.com/ibm/history/history/decade_1980.html. Accessed 10 April 2012.

[iii] Kathrin Hille, ‘Lenovo proves it is a somebody’, Financial Times (4 January 2010).

[iv] Kevin Brown, ‘Long road to recognition for Asia’s brands’, Financial Times (31 May 2010).

[v] Ibid.

[vi] Ibid.

[vii] David Oakley, ‘Emerging markets grow internally, expand internationally’, Financial Times (7 June 2011).

[viii] Ibid.

[ix] Kathrin Hille, ‘Innovation, Chinese stye’, Financial Times (2 February 2012).

[x] Ibid.

[xi] Ibid.

[xii] Ibid.

[xiii] Chuck Salter, ‘Protect and Attack: Lenovo’s new strategy’, fastcompany.com (18 November 2011).

[xiv] Ibid.

[xv] Ibid.

[xvi] http://en.wikipedia.org/wiki/Cultural_Revolution. Accessed 10 April 2012.

[xvii] Chuck Salter, ‘Protect and Attack: Lenovo’s new strategy’, fastcompany.com (18 November 2011).

[xviii] Ibid.

[xix] Ibid.

[xx] Ibid.

[xxi] Ravi Dhar and K. Sudhir with Deepak Advani, ‘How do you take a brand global?’, Qn: A Publication of the Yale School of Management (April 2009).

[xxii] Ibid.

[xxiii] Ravi Dhar and K. Sudhir with Deepak Advani, ‘How do you take a brand global?’, Qn: A Publication of the Yale School of Management (April 2009).

[xxiv] Mure Dickie, ‘Lenovo pact could help ease investor doubts’, Financial Times (31 March 2005).

[xxv] Ibid.

[xxvi] Ravi Dhar and K. Sudhir with Deepak Advani, ‘How do you take a brand global?’, Qn: A Publication of the Yale School of Management (April 2009).

[xxvii] Ibid.

[xxviii] Ibid.

[xxix] Ibid.

[xxx] Tom Kraait, ‘1,000 staff to go in Lenovo restructuring’, ZDNet UK (17 March 2006); Darren Murph, ‘Lenovo laying off 1,400 employees, looking overseas’, Engadget (21 April 2007).

[xxxi] Ibid.

[xxxii] Ibid.

[xxxiii] Ibid.

[xxxiv] Kathrin Hille, ‘Lenovo set to reboot from the top’, Financial Times (5 January 2009).

[xxxv] Robin Kwong and Kathrin Hille, ‘Revamped Lenovo takes battle back to Acer’, Financial Times (17 February 2011).

[xxxvi] Kathrin Hille, ‘Lenovo to buy back handset unit’, Financial Times (27 November 2009).

[xxxvii] 2011/2012 Interim Report Lenovo Group, www.lenovo.com

[xxxviii] Ibid.

[xxxix] Ibid.

[xl] Ibid.

[xli] Alexandra Stevenson, ‘NEC and Lenovo link up’, Financial Times (27 January 2011).

[xlii] Ibid.

[xliii] Kathrin Hille and Robin Kwong, ‘Lenovo buys Medion to bolster Europe profile’, Financial Times (1 June 2011).

[xliv] Chloe Albanesius, ‘HP Reverses Course, Opts Not to Sell PC Division’, PCMag.com (27 October 2011).

[xlv] Ibid.

[xlvi] Ibid.

[xlvii] Maija Palmer, ‘Dell Shrugs off harbingers of PC doom’, Financial Times (8 September 2011).

[xlviii] www.acer-group.com/public/The_Group/overview.htm Accessed April 13, 2012.

[xlix] Sean Smith, ‘Ultra-thin notebooks to take centre stage at CES’, Financial Times (9 January 2012).

[l] www.asus.com/About_ASUS/Winning_formula/. Accessed April 10, 2012.

[li] Robin Kwong, ‘Asus dodges industry gloom’, Financial Times (24 February 2012).

[lii] Damon Poeter, ‘IDC: Strong Q4 iPad, Android tablet sales push 2012 forecast upwards’, PCMag.com (13 March 2012).

[liii] Paul Taylor, ‘Lenovo chief lays down Apple challenge’, Financial Times (21 August 2011).